Get Support

+91 98540 40005

Your Home Loan Down Payment Guide To Buying Flats In Guwahati

Having to pay upfront for a home loan down payment may sound scary, but it is actually the smartest thing you can do to turn your dream of owning a flat in Guwahati into reality.

Buying that dream flat is a milestone that many families look forward to, but saving up for a down payment often feels like the toughest part. It gets trickier for first-time home buyers, but the truth is, it directly impacts how soon you can move into your own home.

And there is hope, because with a little planning, attractive builder offers, and flexible bank schemes, you can get closer to your dream home much sooner than otherwise.

By the end of this blog, you will understand what a home loan down payment is, ways to fund it, saving strategies, and practical tips specific to property in Guwahati.

What is down payment? (And why it matters)

Well, before diving into offers and schemes, lets first understand what a home loan down payment is, so that you have your basics clear.

A down payment is the upfront money that you can pay the seller or the builder of a flat, before a bank finances the rest of your property cost.

We know it isnt a joke when it comes to financing your dream home or preparing yourself for the financial journey that comes with owning a home. In India, the down payment is usually 10-25% of the property value, and paying this upfront can significantly reduce the entire amount.

For example, if a 2 BHK flat in Guwahati costs INR 50 lakh, and your bank covers 80% of the total value, then you will need at least INR 10 lakh as your home loan down payment.

And paying this helps build trust between you, the lender, and the builder, which is an essential part of the home-buying process.

How does the home loan down payment impact loan amount, EMI, and eligibility?

What you pay as your down payment amount has a big effect on your overall finances for the flat you are planning to buy. Think of the down payment as the catalyst that affects your overall eligibility and EMI for the home loan:

How does it impact the loan amount?

-

A higher down payment will mean an overall lower loan size

-

An INR 10 lakh down payment will help you get an INR 40 lakh loan

-

While an INR 5 lakh down payment will get you an INR 45 lakh loan

How does it impact the monthly EMI?

A bigger down payment means smaller EMI, and to help you understand the impact, here is a small example:

-

INR 40 lakh loan at 8.5% for 20 years = ~ INR 34,600 as EMI

-

However, INR 45 lakh loan = ~ INR 38,900 EMI

So, you can see how just an INR 5 lakh difference adds up to INR 4,000+ per month!

How does it impact loan eligibility?

Banks favour buyers with strong down payments because that means your risk is lower. Therefore, the more you are comfortable with paying a good home loan down payment amount, the better it will be working in your favour for your loan eligibility.

However, remember that high-value flats, such as a 3 BHK flat in Guwahati, may require an upfront payment of 20-25% of the total amount.

Pro tip from real estate experts: Balance is key. Dont wipe out all your savings on the down payment and keep funds aside for interiors and emergencies.

Read me: Best Mortgage Tips: A Guide To Financing Your Home Purchase

Builder offers vs. bank schemes: Which works better?

Whenever you plan to buy flats in Guwahati, you will often see builders and banks offering numerous tempting deals. While every offer may seem like the best deal, it is important that you know the differences and understand how they will affect your home loan down payment and the flat ownership journey:

Builder offers

-

They offer flexible payment plans, where you can pay 10-15% of the total amount upfront, and the remaining can be paid during construction or upon possession.

-

Festive Discounts - Around Bihu, Diwali, or New Year, many builders in Guwahati waive charges such as parking or registration, so be open to checking the offers during these times.

-

Subvention Schemes - Pay a small amount upfront, and the builder handles EMI till handover.

-

Often, top real estate companies offer bundled freebies, like modular kitchens, free ACs, or waived maintenance charges.

Tip: These can work best for first-time home buyers who want to reduce their immediate cash outflow, so keep your eyes open for such builder offers.

Bank schemes

-

Low EMI start plans - You can pay reduced EMIs in the first few years, and then gradually step up.

-

Tie-up projects - Many top real estate companies in Guwahati partner with banks for quicker loan approvals, so be ready to explore these opportunities.

-

Balance transfer benefits - If another bank offers a lower interest rate, you can switch later to that banks home loan down payment offer.

-

Special rates for women buyers - Yes, some banks give slightly lower interest if the flat is registered in a womans name.

So, pair it well with your down payment amount and be ready to invest in a home that you can move into without any financial hassles.

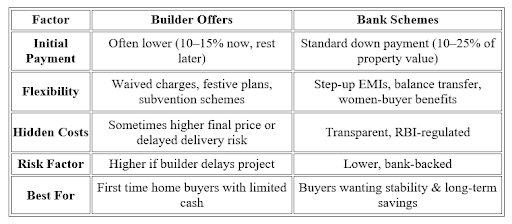

A quick comparison between builder offers and bank schemes

This graphical representation serves as a quick checklist to help you make the best choice.

Builder offers are a great way to quickly enter the real estate market, especially for 1 BHK flats in Guwahati. However, if you are investing in a high-value property in Guwahati, bank schemes will give you more stability.

Read me: Home Finance Guide: Buy Guwahati Flats With EMI, Loans & More

Benefits of a home loan down payment

Buying your dream flat in Guwahati, Assam, will feel so much lighter on the heart (and pocket) when the down payment isnt going to be overwhelming.

Here are some of the ways it will help you step into homeownership sooner without draining your savings completely:

-

Keeps liquidity intact: You will have a separate budget saved for interiors, education, or emergencies.

-

Quick entry: You dont have to wait for years before moving into your dream home sooner.

-

Upgrade flexibility: You can start with a 1 BHK flat in Guwahati, upgrade later to a 2 BHK flat in Guwahati, or 3 BHK without long saving gaps.

-

Ideal for young professionals: The younger generation can start building wealth through real estate early on in life.

At the end of the day, setting aside a down payment isnt just going to be about numbers, but giving yourself the confidence to move forward, knowing you still have financial breathing space.

Real Client experience:

"As a single working woman, I wanted to invest in a 1 BHK flat in Guwahati. The builders festive discount on the down payment came as a huge relief. It allowed me to own my own space without overburdening myself financially." - Meghna Baruah,

How to fund your down payment?

Saving up for a home loan down payment might feel like a mountain to climb, especially for a first-time home buyer. But with the right approach, you will be able to make it manageable and stress-free.

Here are some practical ways to do it:

1. Dedicated savings account

Open a separate savings account or create a fixed deposit just for your down payment. Treat it like a "do-not-touch" fund and make small, consistent deposits regularly to have funds ready when the time comes.

2. Systematic Investment Plans (SIPs)

If your dream 2 BHK flat in Guwahati is a year or two away, start investing in a SIP in mutual funds. It will help you accumulate a decent corpus when funds are needed, while also earning better returns than a normal savings account.

3. Employee benefits or bonuses

Channel your annual bonus, incentives, or any extra income directly into your down payment fund. This way, you will be redirecting your extra income towards a cause instead of spending it impulsively.

4. Personal loan

This is a costly step, but it is one of the easiest ways to build a short-term but effective bridge between your funds and dream home.

5. Family support

In India, its common for families to step in and support big milestones. If your parents or relatives are open to contributing, this will ease the initial burden and is often a go-to option for first-time home buyers.

6. Liquidate idle assets

Think of gold, fixed deposits, or other small investments that have been lying unused. You can redirect them toward your property in Guwahati and get closer to owning your dream home faster.

Read me: Buying An Apartment? Know How GST Affects Cost

Buying smartly: Flats in Guwahati

The one thing that we have learned in this industry, thanks to over two decades of interactions, is that it is always a good idea to know your environment before making a move. If you are planning to buy a flat in Guwahati, it is important that you know not just about how to buy flats in Guwahati, but also understand what works in Guwahati.

Here are some insider tips to help you buy flats in Guwahati:

-

Compare builder offers vs. bank schemes - Dont rush and calculate the long-term impact before deciding what to do.

-

Choose trusted builders - Stick with top real estate companies or well-reviewed builders in Guwahati to avoid risks.

-

Explore emerging areas - Locations like Beltola, Six Mile, and Basistha have great deals on 1, 2, and 3 BHK flats in Guwahati.

-

Resale Value - Flats near educational hubs, upcoming flyovers, or IT areas will fetch higher resale and rental demand. Therefore, consider buying a property in Guwahati near these infrastructures.

-

Legal clarity - Always check project approvals, RERA status, and builder credibility before signing the sales agreement.

-

Flood-free zones - Always check the areas flood history before buying a flat in Guwahati, Assam.

Tip: Always compare. Sometimes, a property in Guwahati under a builder scheme may look attractive upfront, but could mean higher costs later.

Read me: Most Overlooked Sales Agreement Clauses Homebuyers Must Know

Ready to own your dream home in Guwahati?

Your home loan down payment doesnt have to feel like an impossible hurdle in your life.

With the right mix of savings, careful planning, and smart use of builder offers or bank schemes, owning your dream flat in Guwahati, Assam, is well within reach.

Connect now to explore properties.

FAQs

1. What is a home loan down payment?

Its the upfront amount (usually 10-25%) that a buyer pays, while the bank finances the rest.

2. How much down payment is needed for flats in Guwahati?

Typically 10-20% for 1 BHK or 2 BHK flats in Guwahati and up to 25% for premium 3 BHK flats.

3. Which is better-builder offers or bank schemes?

Builder offers reduce the initial burden but may have higher hidden costs. Bank schemes are safer for long-term stability.

4. Can first time home buyers get benefits in Guwahati?

Yes, builders and banks often have special discounts, flexible EMIs, and government subsidies.

5. What documents do I need for a home loan in Guwahati?

ID proof, income proof, bank statements, property documents, and builder approvals.

Looking for a dream home?

We can help you realise your dream of a new home.

0 Comments